Introduction

It was observed by the government that under income tax assessments, many assessees are being harassed from tax officials for their own benefits. Hence, to provide greater transparency, efficiency, and accountability, our government has removed the interface between assessing and assessee officers by introducing faceless tax assessments. In Simple language, now under the e-assessment scheme, if an assessment notice has been served to the assessee then he does not fake watches require to go to the income tax department for proceedings. The scheme came into force in 7th October 2019.

Earlier faceless compliance and faceless assessment was possible only in case of scrutiny assessment defined under section 143(3) however under faceless assessment scheme 2020, the government has broadened the scope of faceless scrutiny and now E-assessment is also possible in case of best fake omega judgment assessment under section 144.

In this article, you will learn how faceless assessment in income tax is done and its benefits.

Analysis of law relating to faceless assessment

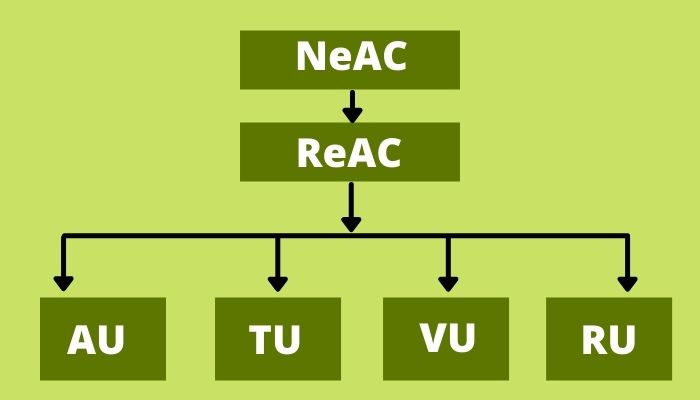

For making faceless scrutiny of income tax, the best replica watches uk government has defined 2 centers which are:

- National Faceless-Assessment Centre (NFAsC) (Centralised Body): The final assessment order is made in this center. Its office is in Delhi.

- Regional Faceless-Assessment Centres (RFAsC) (Regional Centres): This center has further extended into 4 units which are:

- Assessment Units (AsU)

- Verification Units (VU)

- technical Units (TU)

- Review Units (RU)

Every unit has its own functions like Assessment unit will assist in the assessment or analysis of information furnished by the assessee.

Verification unit works for inquiry and cross-verification or recording of statements or examination of books.

The technical unit is used for technical assistance or advice on legal, accounting, valuation or other technical matters.

Review units review the draft assessment order, check whether particular evidence is material or not.

So, in this way, all units have their own functions. Now let’s understand the procedure for making of faceless income tax assessment. Before that, it is necessary for you to understand the sections under which the assessing officer can make the faceless tax assessment:

Section 143(1): Intimation

When you filed your income tax return, it will get processed through electronically by the central processing center (CPC). If there is any or all of the following discrepancies were noticed then an intimation under section 143(a) shall be issued which will be stated the proposed adjustment in your return:

- Any arithmetical error in the return;

- A wrong claim, if such wrong claim is clearly visible from any information in the return;

- Disallowance of loss claimed, if the return of the previous year for which set off of loss is claimed was furnished beyond the due date specified under section 139(1);

- Non-Allowability of expenditure as mentioned in the audit report but not entered while computing the total income in ITR.

Section 143(2): Notice for scrutiny Assessment

If the same amount of total income and tax is mentioned in intimation under section 143(1), then to ensure that you did not:

- Understated the income

- Claimed excessive loss or

- Underpaid the taxes

Your assessing officer shall issue the notice under section 143(2) for scrutiny assessment. This Scrutiny assessment would be made only if you had filed your ITR. Under this notice, the assessing officer has issued a questionnaire that will be related to your accounts, and on the basis of this, he finalized your assessment.

Section 148: Income escaping Assessment

Where the assessing officer has a reason to believe that the person has the income which he did not show in your return i.e. he has an escaped income, then his assessing officer shall issue the notice under section 148 for the assessment under section 147 as income escaping assessment.

Section 142(1)(1): Filing of return of Income

Where the person has not filed his return of income within the due date as specified under section 139 of the income tax act, 1961, then at any time after the due date, the assessing officer may send the notice to the assessee and ask for the filing of return within the period as specified in the notice. Although, the due date for the filing of return is 31st July or 30th September of the assessment year, as the case may be. However, the assessee can still file his belated return within the period of the last date of the assessment year i.e. 31st March and after that, he cannot accept where the notice under section 142(10(i) has been issued.

The procedure of income tax faceless assessment

Step-1

WHERE NOTICE UNDER SECTION 143(2) NOT ISSUED BY ASSESSING OFFICER:

- NFAsC shall serve notice to the assessee under section 143(2): Assessee is required to file his response to NFAsC up to 15 days from receipt of notice

WHERE NOTICE UNDER SECTION 143(2) OR SHOW CAUSE NOTICE UNDER 144 OR NOTICE UNDER SECTION 148 ISSUED BY ASSESSING OFFICER:

- If the assessee has filed its return under section 139 or under section 142(1)(i) or 148

Or not filed its return under section 142(1) or against the notice under section 148

NFAsC to intimate the assessee that assessment shall be completed under section 144B in a Faceless manner

Step-2

After receiving the reply from the assessee within 15 days, NFAsC will assign the case to anyone RFAsC through Automated Allocation System (AAS)

Step-3 During Proceedings, NFAsC will regularly communicate to all the centers and assessee and all units will send the information to NFAsC from time to time. All these communications with the assessee will be made in electronic mode.

Step-4 After collecting and analyzing all the information relating to faceless scrutiny, NFAsC will send the same to Review unit, and on the basis of which such unit will prepare the draft assessment order and sent it to NFAsC.

Step-5 Before issuing the final order, the assessee will be given an opportunity of being heard as to why such an order should not be issued to him.

Key Takeaways

- All communication among the assessment unit, review unit, verification unit or technical unit or with the assessee for the purpose of faceless assessment under income tax shall be through National Faceless Assessment Centre.

- All communications between the National Faceless Assessment Centre and the assessee, or his authorized representative, or any other person shall be exchanged exclusively by electronic mode.

- All notices, orders, or communication to be sent to assessee electronically to assessee’s registered account

- There is no requirement for the assessee to physically present in connection with any proceedings before NFAsC or RFAsC or Technical unit/ Verification unit/ Assessment unit/ Review unit;

- Any examination or recording of statement of the assessee or any other person shall be conducted by an income-tax authority in a unit only through Video Conferencing or Video-Telephony.

Benefits of the faceless e-assessment scheme

Earlier, the assessee was required to visit the Income-tax department for scrutiny, which resulted in an increase in corruption cases, particularly in a higher number of cases. This is where the e-assessment scheme comes into the picture. it is faceless compliance through which the taxpayer would not have to face any assessing officer and report his grievance. So, there is no need for the official or a tax professional for help. Now, You will be able to communicate with the department from anywhere anytime you want with your registered contact number. You will get the response to his query on your registered email id.

We hope that this article will definitely help you out to understand the faceless assessment and faceless compliance in taxation. Still, if you have any doubt wrt to this article or any other matter under direct tax or indirect tax, you can also contact us as we also provide faceless consultancy.